How to invest

Nulla et urna nisi. Nulla condimentum nunc leo, in commodo velit dapibus eget. Quisque id magna eget augue blandit ultricies ac et tellus. Etiam at dui vel lectus rhoncus mattis non at felis.

FAQs

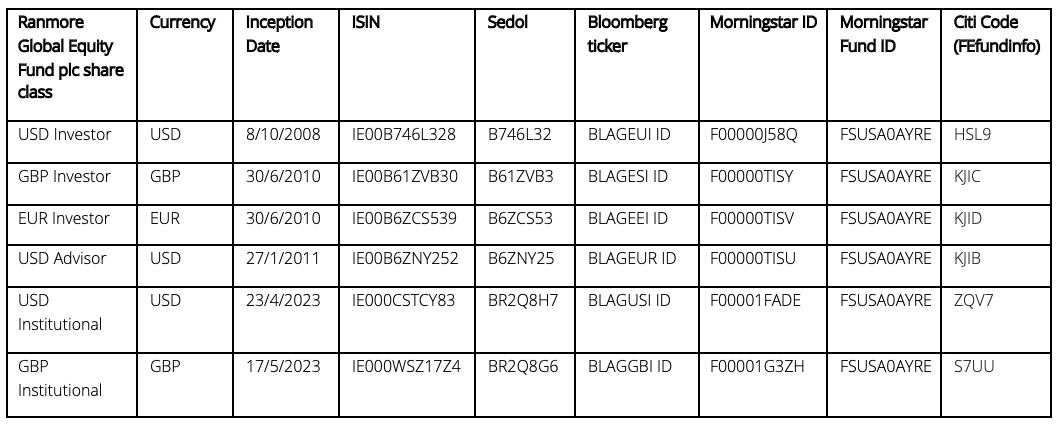

At present, there are only minimum investments in relation to the USD Institutional and GBP Institutional share classes.

No, for regulatory reasons, we can’t offer advice; we can only provide factual information.

As part of its legal obligations, the Fund must undertake certain checks to verify your identity before it can accept investment. These checks are undertaken on the Fund’s behalf by Apex Fund Services (Ireland) Limited (“Apex”). The Fund’s Application Form may ask that proof(s) of your identification (such as your passport) and proof(s) of your residence (such as a utility bill dated within the last three months). This requires photocopies being taken of the original document (eg original passport, original utility bill) and then a certifier (please see below for list of suitable certifiers) compares the copies to the original and writes on the copies When someone is certifying a copy of a proof of your residential address: I certify that this is a copy of the original document – as seen by me Name Date Position Contact number and email When they are certifying a copy of your passport or other proof of ID: I certify that this a copy of the original document – as seen by me – and is a true likeness of the individual Name Date Position Contact number and email

Apex will issue you with a six-digit account number. This number, preceded by the letters ‘RG’ will be your password to open any statements or contract notes sent to you by Apex.

Apex can review your completed Application Form and verification of identity documents on the basis of pdf being sent to apexta@apexgroup.com Apex can confirm that your account is open on the successful review. However, it is Apex’s policy to require investors to subsequently post the original (“wet ink”) Application Form and, in the case of investors from high risk jurisdictions such as South Africa, the original/wet ink versions of their certified verification documents. In the future, should you wish to withdraw money from the Fund, Apex will not pay out such redemption monies until it is first in receipt of the wet ink Application Form.

The Fund currently accepts investments in three currency classes: USD, GBP, EUR The bank account details are on page 3 of the Application Form. The Fund’s bank accounts are maintained in Paris by the French bank, Société Générale. Therefore, if you are making payment from an account outside of France, you will need to select on your banking app/online banking that you are making an international payment. It will then allow you to enter the relevant IBAN as detailed on page 3 of the Application Form. If your bank asks for the country of destination, it is France and the beneficiary is Ranmore Global Equity Fund plc. Please specify the correct currency in which you wish to make payment (eg, if you are subscribing to a GBP share class, please select GBP), otherwise your bank may see that you are making a payment to France and convert your payment into EUR.

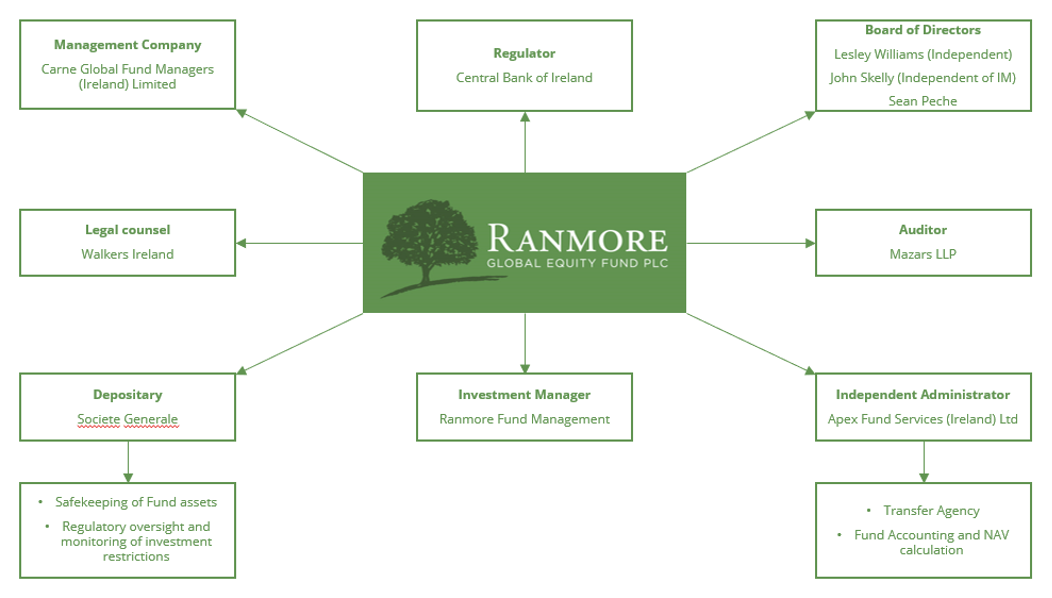

Apex is the Fund’s Administrator. It has two roles: · To calculate the value of the Fund each day · To manage investor account openings and subsequent subscriptions and redemptions

Platforms offer another method to invest in the Fund. For some investors, they offer some advantages versus investing directly: · Administrative – when you invest directly, you are required to complete an Application Form and to provide certain documents which verify your identity. When they invest via a platform, it is the platform or the platform’s distribution partner which opens an account with the Fund. · Tax – for some investors, particularly in the UK, through platforms they can invest via tax-efficient wrappers such as ISAs or SIPPs, which are not available when investing directly. · Simplicity – some investors wish to invest across a range of funds and/or shares. Platforms can offer access to these, which can then be viewed in one account. Platforms typically charge a fee for custody of your assets.

The Fund is an Irish company. Non-Irish investors in the Fund are not subject to Irish tax on their investment.

No. All the Fund’s share classes are accumulation share classes. This means any dividend income the Fund receives will be not paid out to investors, but will be rolled-up into the value of their investments. However, UK resident investors may need to account to HMRC for the deemed income they receive. Please refer to the Reported Income statements on the website for further information.

For those who invest directly, they will receive a monthly statement which shows the value of their investment as at the most recent month-end. They will also be given a login to the Apex Connect portal to enable 24/7 access to their holdings and previous deals. For those who invest via platforms, the value of your investment will typically be updated daily. The prices of the Fund’s share classes are published daily on www.morningstar.co.uk

Morningstar

The Morningstar Rating is an assessment of a fund's past performance - based on both return and risk - which shows how similar investments

compare with their competitors. A high rating alone is insufficient basis for an investment decision. For each fund with at least a three-year history,

Morningstar calculates a Morningstar Rating based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a fund's monthly performance

(including the effects of sales charges, loads and redemption fees), placing more emphasis on downward variations and rewarding consistent performance.

The top 10% of funds in each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the

bottom 10% receive 1 star. The Overall Morningstar Rating for a fund is derived from a weighted average of the performance figures associated with its three-,

five- and 10-year (if applicable) Morningstar Rating metrics.

FE fundinfo

FE fundinfo Crown Fund Ratings enable investors to distinguish between funds that are strongly outperforming their benchmark

from those that are not. The top 10% of funds will be awarded five FE fundinfo Crowns, the next 15% receiving four Crowns and each of the remaining

three quartiles will be given three, two and one Crown respectively.

© 2023 FE fundinfo. All Rights Reserved. The information, data, analyses, and opinions contained herein (1) include the proprietary information of FE fundinfo, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by FE fundinfo, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete, or accurate. FE fundinfo shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, this information, data, analyses, or opinions or their use. FE fundinfo does not guarantee that a fund will perform in line with its FE fundinfo Crown Fund Rating as it is a reflection of past performance only. Likewise, the FE fundinfo Crown Fund Rating should not be seen as any sort of guarantee or assessment of the creditworthiness of a fund or of its underlying securities and should not be used as the sole basis for making any investment decision.